MIS-SOLD INVESTMENT SPECIALISTS – FREE EXPERT CLAIMS ASSESSMENT

We are a small group of people who lost all or part of our life savings through the advice of trusted Independent Financial Advisors or Trustees following the great financial crisis of 2008 / 2009, when hundreds of sophisticated fraudulent investment funds were set up by unscrupulous con artists and insurance companies, together with financial advisors, trustees of pension funds and family trusts, who negligently permitted monies from these funds to be invested in fraudulent schemes.

The resultant effect is that thousands of pensioners and innocent investors lost either all or part of their life savings, leading in some cases to suicides and once financially stable retirees being reduced to relative poverty.

We calculate the entire losses exceeded two billion pounds, and decided that we would not stand for this appalling injustice involving some of the most well-known institutions against whom governments seem either powerless or unwilling to attempt to bring to justice.

If you have lost any or part of your savings with any of these fraudulent funds you are welcome to join our group of investors who are bringing multiple class actions against the perpetrators of these schemes by registering on this site as a first step.

These are some of the Funds which have been recommended for Investment by Financial Advisors and in many cases approved by Trustees on behalf of Pensioners and Beneficiaries of Trusts

THE FUNDS

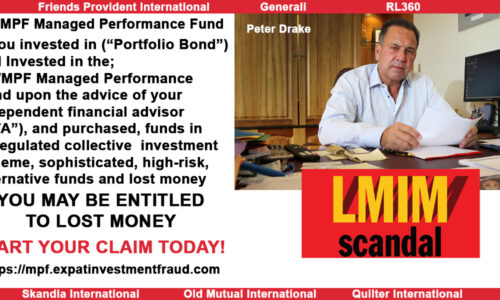

LM/MPF Managed Performance Fund

All other LM Group funds including the Trilogy Wholesale FMIF

Axiom Legal Financing Fund

Premier Group (Isle of Man)

- Eco Resources Fund

- New Earth Recycling and Renewables (NERR)

- Premier Investment Opportunities Fund (PIOF)

- New Earth Solutions Group Limited ( ‘’NESGL’’)

- The New Earth Solutions Facilities Management Limited (‘’NESFM”)

- New Earth Energy Facilities Management Limited ( ‘’NEEFM’’)

- Eclipse Investment Fund

- Premier Eco Resources Sterling Sub-Fund

- EcoEarth Resources Sterling Sub-Fund

- Premier Eco Resources

- Kijani Funds,

- Kijani Commodity Fund

International Mutual Fund PCC Limited

- Canadian Integrated Agriculture Fund

- ClubEasy Fund

- Columna Commodities Fund

- Lucent Strategic Land Fund

Quadris Environmental Forestry Fund Pcc Plc

- Quadris Environmental Forestry Fund

Brandeaux Student Accommodation

KMG SICAV-SIF

Mansion Student Accommodation

Structured notes supplied by Leonteq, Commerzbank, Royal Bank of Canada and Nomura

THE PLATFORM (Insurer)

RL360, Personal Investment Management Service (“PIMS”) by Royal London 360 Insurance Company Limited

Generali, Generali International Vision, Generali International Professional Portfolio

Friends Provident International, Reserve Bond

Skandia International / Royal Skandia, Old Mutual International, Quilter International, Executive Investment Bond, Executive Redemption Bond

Hansard Global, Hansard Capital Investment Bond, Hansard International Portfolio Bond, Universal Personal

AXA Wealth International, Legacy Planning Bond (LPB), Estate Planning Bond (EPB),

Canada Life International, Premiere Account, Premiere Europe

Custodian Life, Exclusive Investment Bond (EIB)

Investors Trust, Access Portfolio Bond

Nedbank Group Limited, Nedbank Private Wealth

Premier Trust

Prudential International, International Prudence Bond

SEB Life International, SEB Portfolio Bond, Personal Portfolio Bond

Standard Life International, International Bond

Zurich International (including HSBC International Wealth Builder Accounts)

WHERE WERE THESE FRAUDULENT FUNDS SOLD

Everywhere the Promoters of these fraudulent products could operate with impunity from Financial Product Laws such as those applied in the UK and the US. The main countries where these Fraudulent Schemes proliferated or were enhanced by the actions of Pension Fund Trustees were Brazil, Spain, Cyprus, Thailand, Indonesia, Hong Kong, United Arab Emirates(UAE), the Middle East, Malaysia, Japan, South Africa, and the offshore Tax Havens of the Channel Islands of Guernsey, Gibraltar, Jersey, the British Virgin Islands, the Cayman Islands and the Isle of Man, Malta, Labuan.

If you have suffered financial loss through purchasing an Investment Fund you are welcome to join us. Or if you have suffered Financial Loss through the actions or advice from a Financial Advisor or a Trustee of a Pension Fund or Family Trust or the Negligence of your Legal Advisor or Firm you may well have a case for recovery of your losses. Most Pension Trusts relate to Retirees who rely upon the advice and actions of their Trustees who control the Pension Funds such as QROPS or SIPP and as such have a duty of care to invest your Funds in secure low-risk securities, Funds, and Investments. Many have failed in this duty and may be legally responsible for your losses.

Likewise, Legal Firms have a very high duty of care to advise and act in your interests such as bringing proceedings within certain time limits and advising you as to the Law which might apply in your circumstances.”

Click on the button START YOUR CLAIM Today! Read more

Check with us if you had

mis-sold investment

Fill in our online application to start your claim now

no win. no fee.

PAY NOTHING UNLESS WE WIN YOUR CASE

Latest News

Seeking Justice: The Class Action Battle Against Insurance Giants

Introduction: In recent months, a high-stakes class action has been unfolding, capturing the attention of investors, legal experts, and the ...

Read the full articleFriends Provident International Concludes Defense in Major Class Action Trial

Friends Provident International Concludes Defense in Major Class Action Trial Friends Provident International (FPI) has wrapped up presenting its defense ...

Read the full articleThe Legal Battle Unveiled: Investors vs. Isle of Man Insurance Giants, Friends Provident International and Utmost International

Read the full articleOffshore Investment Bonds The SHOCKING FACTS financial advisors don’t want you to know

Read the full articleLM/MPF Managed Performance Fund If you were a victim of the LM Investments, There is still hope of recovering your lost money.

LM/MPF Managed Performance Fund If you were a victim of the LM Investments, mis-management of funds, fund fraud, Breach of ...

Read the full articleIoM’s New Earth boss slams regulator probe a ‘witch hunt’

John Bourbon, the former director of Isle of Man-based Premier Group, the company behind the ill-fated £300m New Earth Group of funds, has described the regulator’s decision to investigate allegations of mis-selling against the fund manager “something of a witch hunt”.

Read the full articleTHE LMIM COLLAPSE: ONE YEAR LATER, AN INVESTOR SPEAKS OUT

2/4/2014 “I was completely shattered, my life in ruins” Dozens of expats in Thailand lost their life savings when the ...

Read the full articleMystery surrounds bamboo plantations

The liquidator of the bankrupt Eco Resources Fund, which has cost shareholders and creditors in faraway bamboo plantations many millions of pounds, has been told the US finance company which now owns the forests may be willing to sell the assets back to ERF for $10 million.

Read the full articleLM frozen funds: commissions before client earnings

ByMichael West July 30, 2013 — 12.11pmSave ShareNormal text sizeLarger text sizeVery large text size Advertisement The financial ...

Read the full articleThe expat pensions that vanished

Rogue salesmen snared hundreds in a mis-selling scandal. Now big firms and regulators are under scrutiny. Manita Khuller had only ...

Read the full article