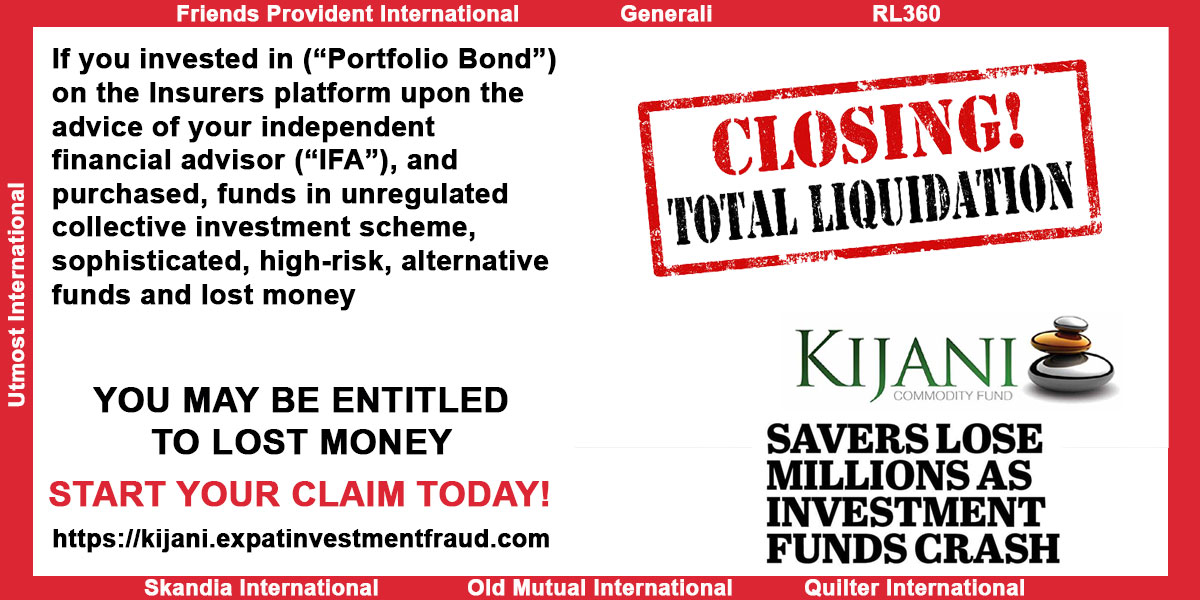

If you have purchased the Kijani Commodity Fund through a trustee or direct on the insurer’s platform and have lost money you may be entitled to recover money lost.

If you bought the fund via a UK-regulated pension, such as a SIPP or QROPS, you could be eligible to claim with the Financial Services Compensation Scheme (FSCS) and receive compensation. This does not exclude you from joining the group action.

Expat Investment Fraud is helping people recover money lost. If this information relates to you or someone you know, please share this with them so we can try and reach those affected by these funds.

Please complete the questionnaire below to join our group action today!

The Kijani Commodity Fund is the largest cell within Brighton SPC, a Cayman Islands-based fund. The fund had positive returns for investors in 49 of the 51 months it was trading, which was attributed to strategies such as commodity trading arbitrage. It was seized by Cayman authorities for an inability to verify its assets in June 2015.

Kijani mean green in Swahili and was described as “the commodity equivalent of fair trade coffee” in 2011. The fund was marketed to individual investors in Asia and the Middle East, investing in gold, oil, and timber. Early on, it received $5 million in seed capital from billionaire Nadhmi Auchi, which was used for trading gold in Ghana.

In 2014, it was re-domiciled to the Cayman Islands to attract UK investors. The Cayman Islands Monetary Authority (CIMA) placed Brighton SPC in controllership following a forensic examination by PricewaterhouseCoopers. The audit found that the fund’s only asset was a commercial loan to its primary company, Kijani Resources. The Kijani Commodity Fund voluntarily suspended its trading activities in March 2015.

In June 2015, Kijani had more than $130 million in managed assets that were seized by Cayman authorities. In October 2015, CIMA announced that Brighton SPC had been placed in liquidation by PricewaterhouseCoopers.