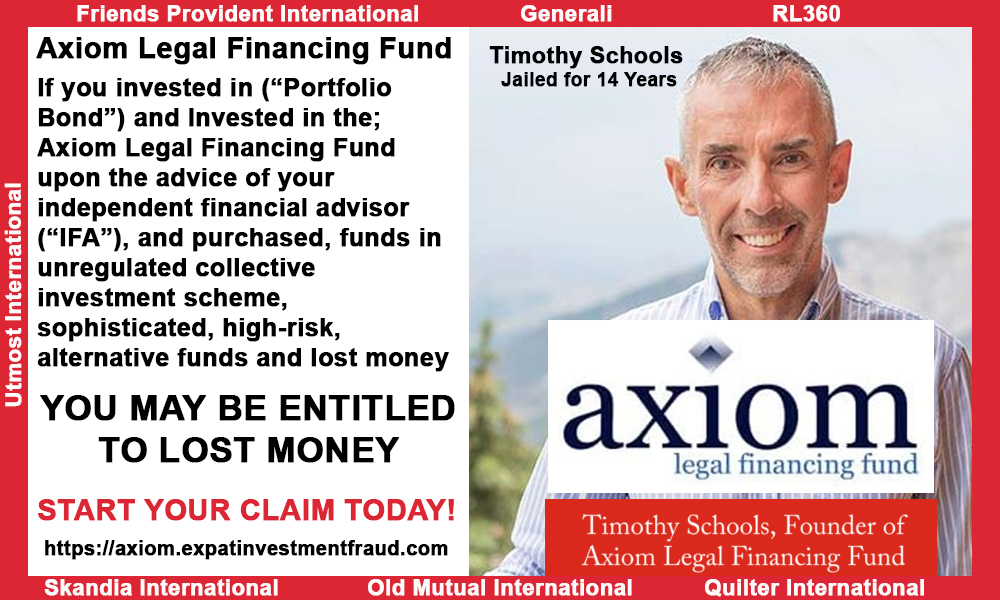

If you have purchased the Axiom Legal Financing Fund through a trustee or direct on the insurer’s platform and have lost money you may be entitled to recover money lost.

If you bought the fund via a UK-regulated pension, such as a SIPP or QROPS, you could be eligible to claim with the Financial Services Compensation Scheme (FSCS) and receive compensation. This does not exclude you from joining the group action.

Expat Investment Fraud is helping people recover money lost. If this information relates to you or someone you know, please share this with them so we can try and reach those affected by these funds.

Please complete the questionnaire below to join our group action today!

In or about 2012, Axiom was incorporated in the Cayman Islands and operated by investment manager, Tangerine Investment Management Limited – also incorporated in the Cayman Islands. The Insurers accepted Axiom onto the Bond platform in or about 2012, after conducting a due diligence.

The director of Tangerine (the fund manager to Axiom) was a UK solicitor, Timothy Schools (Schools), who was the sole director of Tangerine and operated a law firm, ATM Solicitors Ltd (ATM Solicitors) in the UK. Schools operated Axiom and played multiple roles, including

founder, investment manager, loan manager, director and promoter. Funds were lent to various entities through ATM Solicitors.

Tangerine was incorporated in the Cayman Islands on 19 December 2011 and took over as investment manager for Axiom from The Synergy Solution Ltd – a company owned by Schools’ wife and others in the UK. The Insurers reviewed the operations of Axiom, valued the fund and undertook due diligence on

Axiom, Tangerine and Schools before admitting Axiom onto the Bond platform in 2012.

Between 2007 and July 2012, the UK Solicitors Disciplinary Tribunal (SDT) took action against Schools for misconduct. Schools was also involved in a number of companies that went into either administration or liquidation between 2000 and 2012 – namely Life Repair Group Ltd, Life Repair Sales Ltd, Fast Track Litigation Services Ltd, Fast Track Indemnity Ltd, CMS Investigations Ltd, Pulse Mobile

Ltd and Rococo Joe’s Ltd.

The Decisions of the SDT and the failed corporate entities are searchable by name and entity in the UK. The IFAs in the jurisdictions promoted, marketed and sold Axiom as a fund approved by the Insurers on the Bond platform to investors and other customers.

The Insurers received fees from Tangerine for placing Axiom on the Bond platform. The Insurers sent to investors and other customers periodic valuation statements on Axiom. IFAs continued to send applications to the Insurers from investors and other customers for the

purchase of Axiom units on the Bond platform in or about December 2012. These applications were accepted and processed by the insurers.

Axiom went into receivership in December 2012, and this still continues. No funds have been returned to investors. It still owes more than £120 million, and there is no prospect of any monies being returned to investors – amongst whom are many elderly investors from the UK.

Axiom has been exposed as a fraudulent fund, and there are numerous proceedings in the UK by investors against Axiom, Schools and others. A Grant Thornton report points to substantial evidence that the money lent to law firms from Axiom was misused under the terms of litigation

agreements. Criminal action is being taken against the directors.

Axiom Legal Financing Fund founder Timothy Schools was sentenced to 14 years in prison for multiple offenses in 2022.