The shocking facts financial advisers don’t want you to know

As you have downloaded this guide, I guess you are an expat with an offshore investment bond. The facts you are about to read may surprise, perhaps even shock you. They may make you feel aggrieved. But they could also help you gain control, security, and peace of mind.

Before we go any further I want to get one thing straight: there is nothing inherently wrong with offshore bonds.

They are just a ‘tax wrapper’. If set up the right way, they can be a perfectly appropriate investment. However, not every expat needs one. In fact, for many people living outside the UK, the tax savings are largely irrelevant and other options will often provide more flexibility.

What is wrong with the vast majority of offshore bonds is how they have been set up. By this I mean the commission paid to your adviser; the investment advice you have been given; and the ongoing service or lack of it.

Let me explain

So, if you invest £100,000, your exceptionally friendly and attentive ‘adviser’ could receive £12,000 in initial commission. I say ‘could’ because in stark reality, they could receive significantly more. Once all the smoke and mirrors have been deployed, it is not impossible for advisers to take upwards of £17,000 commission on a £100,000 bond.

That is a startling £17,000 or more over time on every £100,000 you invest, which would devastate your returns!

So where does this money come from? Quite simply, you. And if you do not recall ever signing a cheque to your adviser, there is a simple reason.

This is exactly the problem with offshore investment bonds.

Do you realise that when you buy a bond, it is not unusual for the vendor to receive 8% commission from the bond provider? And, on top of that, up to 4% for the investments they recommend within it.

So, if you invest £100,000, your exceptionally friendly and attentive ‘adviser’ could receive £12,000 in initial commission. I say ‘could’ because, in stark reality, they could receive significantly more. Once all the smoke and mirrors have been deployed, it is not impossible for advisers to take upwards of £17,000 commission on a £100,000 bond.

There is a famous story of a visitor in New York City more than a century ago. Walking along the docks, he admired the yachts owned by the heavy hitters on Wall Street. He then wondered where the customers’ yachts were. Of course, there were none. All the benefits had gone to the advisers rather than the clients.

Commission payments are often far from explicit. They are gradually deducted as investment and account charges over the first few years. You are contractually forced to pay them and may well find yourself locked into the bond for years to come, despite what your adviser tells you.

So where does that leave you?

Even with good investment growth, you may not make any money for the first 15 years of an investment (you can see all the figures, on page 5). That is assuming the commission payable is a conservative 6% rather than the 17% I mentioned.

Moreover, crippling charges are not the only problem. There is another related factor likely to prevent you from achieving the investment returns you deserve and hope for.

Although a bond allows you to invest pretty much anywhere, not all investments pay the same commission. So, advisers will often recommend the highest commission-paying funds, rather than those best suited to you.

In my career I have come across hundreds of clients invested in unsuitable and expensive investments. Even worse, many have no idea until they decide to cash in their bond and find it is worth far less than expected, sometimes much less than they invested in the first place.

Lastly, there is yet another problem: service or lack

of it. Again, this goes back to the commission. Your adviser receives all the commission upfront on day one. Hence, once the policy has been sold, they have very little incentive to serve you unless you can give them more money or introduce them to your friends (referrals) from whom they can also make money.

No boss would ever pay an employee the whole 10-year salary on their first day at work. If they did, would the employee turn up and perform well day after day? Probably not.

This is exactly what happens here.

If you have even the slightest concern that anything I have said may apply to investments you hold or are considering, please read the following pages carefully. We explain in simple terms what bonds are, show the effect of charges and investment selection on your returns, and tell you what practical steps you could consider to avoid or minimize these risks.

At the very least, this guide will help you avoid nasty surprises, and, even better, hopefully, build a more prosperous and transparent financial future.

What are offshore investment bonds and their tax benefits?

Offshore bonds are an investment ‘wrapper’: a tax-efficient container you can fill with pretty much any investment you like, though usually with the exception of physical property.

They can be attractive because of their tax efficiency in certain countries.

To put it simply, if you invest in a fund directly, you could be liable for tax in some countries. However, if you hold the same fund in a bond, you could save or at least defer that tax.

The value or significance of these benefits depends on the tax rules of the country in which you reside for tax purposes.

If you live in a high-tax jurisdiction such as the United Kingdom, you may find the tax benefits of the bonds relevant and valuable to you. Conversely, if you live in a low or no-tax jurisdiction such as the United Arab Emirates, you may find investing through a bond makes little or no difference at all to your tax position. In fact, you could be building up a large future tax liability.

Despite this, perhaps because of the levels of commission involved, international advisers tend to present offshore bonds as the panacea for all expat investors. Indeed, they are the most commonly held investment product amongst expats.

Who are the main offshore investment bond providers?

The main providers are typically the offshore arms of large international insurance companies. These include:

• AEGON Scottish Equitable International

• AXA Wealth International

• Canada Life International

• Clerical Medical (CMI Insurance Limited)

• Friends Provident International (soon to be Aviva)

• Hansard International

• Generali International

• Irish Life International (now SEB)

• Royal London 360 (now RL360)

• Royal Skandia (now Old Mutual International)

• Zurich International

How much do you pay for an

offshore investment bond?

In the world of investment, of course, nobody knows for a fact if and by how much your money will grow. The only certainty is the charges you pay.

In my 12 years as an international financial adviser, I have reviewed hundreds of products, each with a different charging structure and fees ranging from overpriced to downright exorbitant. A disturbing number were towards the upper end of the spectrum. Most people are paying way too much for a perceived benefit they may never receive.

How much is too much?

Based on my experience, a typical investment bond investor could be paying:

• 0.5%-1.5% annual charge to the pension or bond provider

• £400+ fixed annual fee to the bond provider

• 1.5% a year establishment charge for the first 5-10 years

• 3-8% initial commission on the investments held in the bond

• 1%-3% annual charge on investments (this could be much more, and more opaque if you are invested in structured products)

This can add up to annual charges in the region of 6% with initial charges of up to 8%, although, as I said, these can sometimes be much higher. You would need staggering performance year after year just to cover all the charges. What is worse, those charges are often hidden, so only those with degrees in maths can work out their total costs in real terms.

The following examples should help bring this to life.

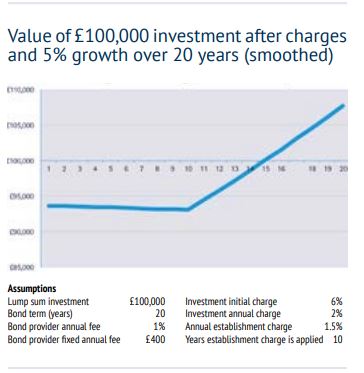

Consider someone who invests £100,000 for 20 years. How much would their investment be worth in the end? How much would they have paid in charges?

In the first example, we shall assume the investment grows by an average of 5% a year (this is the mid-rate for projections recommended by the FCA, the UK Financial Conduct Authority).

As the graph shows, the investor in question would only start making money after 15 years. By the end of the 20 years, their £100,000 investment would be worth £107,768 – that means an abysmal effective return of just 0.08%, despite the steady rise in the stock market. This is because of the £88,698 paid out in total in charges.

But what if the investments perform really well?

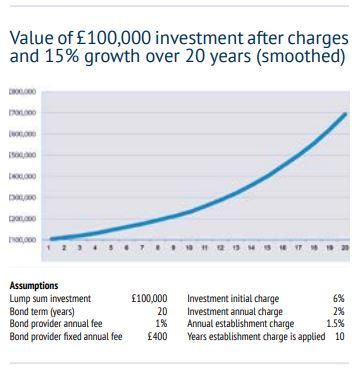

What happens to the graph if the same investment enjoys average annual growth of 15%? To put things in context, in the period from 1900 to 2013, developed markets have enjoyed an average annual growth of 8.3%, whilst emerging markets have a growth of 7.4%.

With an average annual growth of 15%, the graph looks remarkably less scary than the previous one. Or does it?

It is true the investor starts making money in the first year and by the end his £100,000 has turned into £695,318. However, they will have paid £226,259 in charges (a higher amount than the previous example because of the higher fund value). Moreover, despite the prolonged market rally, because of the charges, they will have experienced an effective average return of just 5.95% a year. Charges have swallowed up nearly two thirds of the market growth.

It is like swimming with weights. You need a lot of effort and energy just to stay afloat, and when you move forward, you do so much more slowly and painfully than you would otherwise.

So where does your money go?

A significant chunk is used to fund the adviser’s commission. The rest goes to the product provider and the investment manager.

When the adviser sells the bond to the client, at the outset they receive in the region of 7% upfront from the bond provider. The 1.5% annual establishment charge you pay for the first 5-10 years funds this and can add up to 15% over time. If you leave the offshore bond before paying off all these charges, they will be clawed back from you, resulting in either horrible penalties or a lack of flexibility.

When the adviser recommends the investments, they can also receive a large proportion, if not the whole, of the investment initial charge. This is typically 4%-8% but on some investments, such as structured products and hedge funds, it could be much more. This is either directly deducted from your original investment or ‘back-end loaded’, so you cannot see it – just like the bond itself (thereby accentuating the lack of flexibility).

After selling the product, the broker or ‘adviser’ is unlikely to receive any further commission. For instance, they do not normally receive any part of the annual investment charge. This means they will not benefit if your investments grow in value and conversely will not suffer if they fall. Quite simply, their interests are not aligned with yours.

Why such crippling charges?

Such shocking charges are the result of the way these types of financial products are sold, combined with a lack of competition and lax regulation. The international financial services industry today bears a striking resemblance to the UK financial services industry 30 years ago.

Most products are sold through international brokerages and their direct sales teams who masquerade (but are nothing of the sort) as ‘financial advisers. They need to be paid, and so do the product providers. As all the main protagonists use the same business model and make money the same way, it is in nobody’s interest to apply fairer prices. Nor is there any regulation that prescribes what a fair price should be.

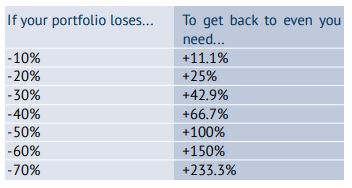

The odds are stacked against you

As the graphs show, you need some pretty exceptional investment performance over a long time to have any growth left after paying the extortionate charges.

How do you achieve that?

In many cases, the adviser’s answer is to recommend racier investments that on paper look as though they could deliver that exceptional performance.

However, the racier the investments, the higher the risk of them suffering a horrific fall. If that horrific fall happens within the first few years from the establishment of the bond, there might be a chance

to recover. But what if it happens a couple of years before you need access to the money?

To add insult to injury, these types of investment

often attract much higher charges than more mainstream ones. So, typically an adviser profits much more from recommending them.

This does not mean highly risky investments should always be avoided.

They can play an important role as part of a well-balanced and diversified portfolio, subject to in-depth research and continuous monitoring.

However, many of the portfolios we see are stuffed full of expensive esoteric investments (e.g. structured products, hedge funds, etc.), dangerously undiversified. This leaves the client at risk of losing a huge portion, if not indeed all, of their investment.

In my experience, this is because of the two reasons I have mentioned earlier:

1. A well-diversified portfolio will aim to avoid excessive volatility (the very high highs and very low lows typical of more specialist investments). However, this means the potential returns of a diversified portfolio may well not be enough to cover the charges.

2. As a rule of thumb, the more ‘alternative’ and opaque the investment, the higher the commission the salesman receives, therefore, sadly, the more likely they are to recommend it.

Would you be happy to have an investment portfolio that is in effect an elaborate gamble, in which the

only guaranteed winner is the outwardly trustworthy, charismatic broker?

In addition, this type of portfolio is far from a ‘buy and forget’ investment. It calls for in-depth research both at the outset and ongoing. Yet, in my experience, very few IFAs have the time, resources, expertise, or even incentive to conduct quantitative and qualitative analysis on the investments they recommend.

What could you do?

If you have even the slightest concern that you have been sold an expensive offshore bond, loaded with unsuitable investments, you should look into it.

If I were reviewing my own portfolio, the main questions I would ask are:

1. How much am I paying in charges – and, indeed, what charges am I paying?

2. Where is my money invested? I would like to see a full breakdown of all the investments in my bond.

3. How have the investments performed to date? And how does that compare to the relevant benchmark? So, for instance, if I hold a fund investing in emerging markets, I would want to see its performance compared to the average of the sector.

4. How diversified is my portfolio? I would want

to see what exposure I have to different asset classes, sectors, and geographical regions.

5. How risky is my portfolio? I would want to make sure I am happy the risk profile matches my appetite for risk.

6. Are there any alternatives that offer lower costs, better potential returns, or ideally both?

7. What are the charges or penalties if I were to change my investments or transfer out of the bond?

This information should be included in statements or valuations you might have received from your adviser.

Failing that, you could contact the bond provider and the investment companies to find out the different elements you need to unwrap the opaque charges and build up the full picture.

This could be time-consuming and potentially involve dealing with a number of companies, with different procedures and rules.

Can someone help?

CLIENT CASE STUDY

“I now realise I’ve been funding my former advisers’ retirement, not my own”

David Brown | Development Manager | Brunei Darussalam

“I’m a Chartered Engineer and have worked in the oil and gas sector around the world for 20 years. In that time, I’ve met various outwardly trustworthy international financial advisers who have let me down time and again.

Being analytical, I’m predominantly interested in the performance of my investments. Over the years I’ve consistently failed to get any. Worse, I’ve lost money.

I was looking for a fresh approach when a friend from my military days introduced me to AES International.

I now realize I’ve been funding my former advisers’ retirement, not my own. AES International applies a rigorous and analytical method of reviewing risk against expected return. Their transparent cash flow modeling approach is something my wife and I have been seeking for years. It’s entirely different from my previous experiences with financial advice.

I now understand the importance of cash flow modeling, have a detailed plan which will save me tens of thousands of pounds, and am really clear on the performance I need to retire well.

My wife and I were so relieved to come on board, feel very confident in our choice, and look forward to a relationship that both saves and makes us money.”

What happens next?

Why should you trust AES International?

You are probably thinking: “Why should I trust you? Aren’t you just another financial adviser?”

I do not blame you. As this guide shows, the international financial advice industry has done little over the years to deserve clients’ trust.

I discovered this myself in the most unusual way.

Like most of the Board of AES International, I was previously a British Army Officer. We have all been inculcated with the military values of integrity, and are passionate about maintaining the highest standards of professionalism.

I was first commissioned into the Queen’s Guards, then was selected for service with the Airborne Forces. This led me to travel around the world and meet fellow servicemen and expats.

From talking to them, I was appalled at the poor quality of much international financial advice.

So I obtained the necessary qualifications and started AES International in 2004.

With other like-minded professionals, I embarked on a crusade to transform a toxic industry that manufactures and vends ‘products’ into a profession that helps people understand, protect and build their assets better than any other organization.

Because of my Army background, our first clients were soldiers, military and logistical contractors based in hostile territories.

Then, as the company grew, we extended our transparent and professional services to other expats.

By 2012, we were Britain’s fastest-growing financial business according to The Sunday Times Fast Track 100.

In the last few years, we have won over 26 financial awards, including Best Global Offshore Banking Team in 2014, Best Private Wealth Manager Adviser in the UAE in 2014, and Best International Financial Planning Firm in 2013.

What makes us different?

Our organization’s ethos is like the military’s. The highest standards of professionalism and integrity are not only expected but demanded.

1. A beacon of British standards abroad: Our UK business is authorized by the FCA (including for pension transfers) and we hold investment and insurance licenses in 36 different countries. Our professionally qualified advisers challenge the status quo and all adhere to a partnership code that governs the uniquely transparent and professional way we interact with our clients. We understand the international/cross-border marketplace and all its challenges as this is all we focus upon.

2. A different business model, where the company’s interests are perfectly aligned with our clients’: Unlike most international IFAs, we do not rely on huge initial commissions. Instead, we retain a very small percentage of the amount you have invested with us over time.

This means you pay substantially less initial commission and do not have to wait years before seeing any growth in your investments.

It also means our best interest lies both in recommending decent products and investments and also looking after you and your portfolio over time. The more your investments grow, the better we serve you and the longer you stay with us, the more we make. If we disappoint you and you leave us, we lose money.

3. Centralised Investment Research: Investment performance is critical and we believe it is wrong to put your faith in an individual financial adviser to select and manage your portfolio.

This is why we have created an independent and centralized Investment Team. They are responsible for ensuring clients have access to the very best funds which are of sufficient quality, match client risk profiles/expectations, and are managed in an appropriate manner.

The Investment Team applies quantitative and qualitative analysis to arrive at a White List of Funds – the funds they believe most likely to deliver superior returns over time across different sectors and risk profiles.

We recognize that no single investment house has a monopoly of investment expertise, so we remain

CLIENT CASE STUDY

“I have much greater security and confidence”

Louiza May | International Teacher | UAE

“As an international teacher and single parent, my life is hectic. I haven’t had the time or knowledge to get involved with my finances.

Like many teachers, I was indirectly introduced to someone I now know was an unregulated international adviser. He made some fantastic sounding promises regarding my UK Teachers Pension Scheme: enhanced benefits and flexibility to secure my daughter’s future.

Although I never received a clear explanation of how the adviser made money, he was so friendly and attentive on his visits to the school, by phone, and by email that I proceeded with his recommendation. I moved my pension to a QROPS which the adviser then invested into a Royal London 360 Offshore Bond.

Almost immediately after this, I met AES International. I was shocked to discover I had inadvertently forfeited my guaranteed pension rights and inefficiently taken out a tax wrapper within a tax wrapper. I also realized the QROPS, Offshore Bond and the investments within it were most likely unsuitable. AES also showed me how

to read and understand my RL 360 valuation so I saw I had immediately lost 20% of the transfer in value in hidden charges.

I had mistakenly put my faith in a charismatic individual, not an organization. I, therefore, completed a one-page form and switched the agency of my investment to AES International.

The fact that AES International is so highly regulated, has won a lot of awards, is a large, completely, and utterly transparent international business with a centralized investment team, has given me genuine and well-founded peace of mind – my daughter’s future is safe and secure. I can now hope my pension will recover in value over time.

I now understand how the allegedly ‘free’ advice works and stand to make savings of £100s of pounds a year whilst hopefully getting the performance my retirement account really deserves it.

Overall, I have much greater security and confidence moving forwards.

fiercely independent, and carefully select a small number of both passive and active managers of truly outstanding ability.

This process delivers transparency, peace of mind, security, and performance which are simply unattainable through a single adviser.

4. Centralised compliance and risk management: we have a compliance team based in the UK. They review every single piece of information and every

recommendation we send our clients worldwide, to ensure it adheres to the highest regulatory principles regardless of jurisdiction and is in the client’s best interest. This is not a requirement. It is a choice.

5. A team-based approach to servicing: Our contact centre is open 6am-5pm GMT. It is staffed by QFC Level 4 qualified advisers and client service professionals available to answer questions and support you and where appropriate your adviser in providing a high level of ongoing service.

We are happy to take the strain

You may be one of the few investors whose bond has been responsibly set up and consequently is not crippled by exorbitant charges. If so, the free review will confirm this and help you put any concerns to one side.

If, however, your offshore bonds were set up less than responsibly, as is sadly all too often the case, we

are happy to take the strain. Simply click on the button below and request a no-obligation consultation with a member of our centralized investment team.

We can help you stop building someone else’s wealth and concentrate on building your own.

IMPORTANT NOTE: This guide aims to provide general information on offshore investment bonds. It is a short and simplified summary of a complex subject, so please do not make any decisions based solely on the contents of this guide. Whether or not an offshore investment bond and the investments within it are appropriate to you will depend on many factors, including your individual needs and circumstances.