21 August, 2020 | Case Updates

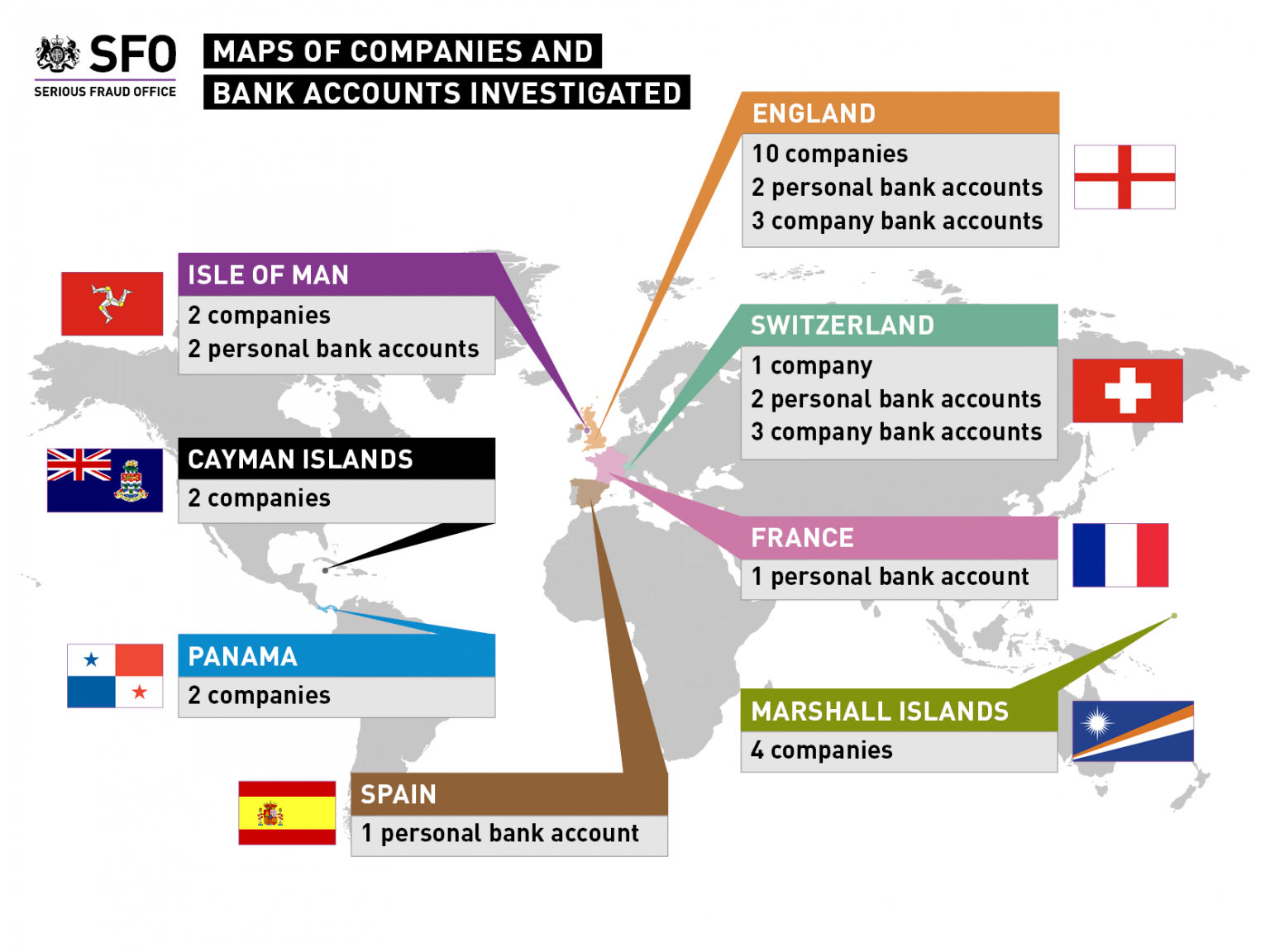

The Serious Fraud Office has charged three men with multiple offences in connection with its investigation into the collapse of the Axiom Legal Financing Fund. Timothy Schools, David Kennedy and Richard Emmett are charged with carrying out a fraudulent scheme to divert money from the Axiom Legal Financing Fund for their own benefit.

The case will be listed at Westminster Magistrates’ Court on Wednesday, 30 September 2020.

Notes to editors:

- Timothy Schools (DOB 19.03.1961), a former solicitor, has been charged with three counts of fraudulent trading, contrary to Section 993(1) of the Companies Act 2006, one count of fraud, contrary to Section 1 of the Fraud Act 2006, and one count of transferring criminal property, contrary to Section 327(1)(d) of the Proceeds of Crime Act 2002.

- David Kennedy (DOB 07.01.1953), a former independent financial adviser, has been charged with one count of fraudulent trading, contrary to Section 993(1) of the Companies Act 2006.

- Richard Emmett (DOB 02.07.1973), a former solicitor, has been charged with one count of fraudulent trading, contrary to Section 993(1) of the Companies Act 2006, and one count of being concerned in an arrangement that facilitates the acquisition, retention, use or control of criminal property by another, contrary to Section 328(1) of the Proceeds of Crime Act 2002.

- The SFO announced its investigation on 16 May 2017.

- As these are live criminal proceedings, the SFO cannot comment further. The strict liability rule of the Contempt of Court Act applies.