Introduction: In recent months, a high-stakes class action has been unfolding, capturing the attention of investors, legal experts, and the public alike. The case revolves around the alleged misrepresentation and failure of due diligence by two insurance giants, Friends Provident International and Utmost International the Isle of Man. In this blog post, we will delve into the details of this class action, examining the claims, the defendant’s response, and the implications of this legal battle.

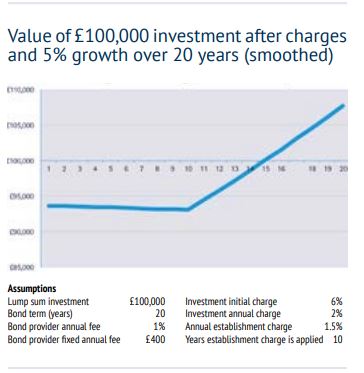

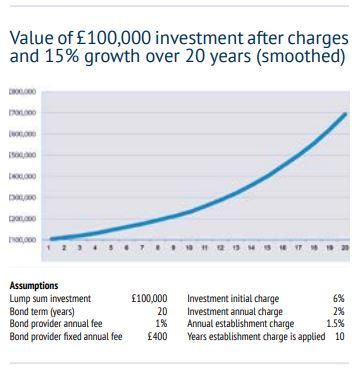

The Allegations: More than 700 investors, many of whom lost their life savings, have come together in a unified effort to seek justice and compensation for their financial losses. The claimants, consisting mainly of British nationals and expats, argue that they were sold life assurance products that were marketed as safe and low risk. However, these products were based on investment funds that ultimately collapsed, leaving them with nothing.

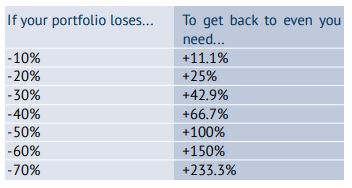

Misrepresentation and Negligence: The heart of the class action lies in the claimants’ allegations of misrepresentation and negligence by the insurance companies. They argue that Friends Provident International and Utmost International failed to carry out the necessary due diligence on the underlying funds and provided misleading information about the level of risk involved. Additionally, it is alleged that the companies continued to charge management fees on products that had become worthless after the funds collapsed.

The Response: Both Friends Provident International and Utmost International have vehemently denied any liability and have vowed to contest the claims. They assert that the investments were made through independent financial advisers and intermediaries, who were responsible for asset vetting and selection. The defendants argue that the advisers, not the insurance companies, should bear the responsibility for any due diligence failures.

The Significance: This class action carries significant implications not only for the investors involved but also for the insurance industry as a whole. It raises important questions about the responsibilities of financial institutions in ensuring the accuracy and reliability of the investments they offer. The outcome of this case could set a precedent for future disputes and shape the regulatory landscape surrounding investment products.

The Pursuit of Justice: As the trial draws to a close and closing submissions are made, the investors and the defendants await the court’s decision. The resolution of this class action could potentially provide the much-needed compensation and closure for those who lost their life savings. It also serves as a reminder of the importance of consumer protection and the accountability of financial institutions.

Conclusion: The class action against Friends Provident International and Utmost International Isle of Man represents a battle for justice and compensation for the investors who suffered significant financial losses. The allegations of misrepresentation and negligence have brought to light important issues surrounding due diligence and the responsibilities of financial institutions. As this legal battle nears its end, the outcome will shape not only the lives of the claimants but also the future practices of the insurance industry.